does the irs write off tax debt after 10 years

Easily compare Tax Relief companies by the good and the bad reviews. See if you Qualify for IRS Fresh Start Request Online.

Who Goes To Prison For Tax Evasion H R Block

The IRS then has up to three years after accepting your return to assess the tax owed.

. However some crucial exceptions may apply. Specifically Internal Revenue Code 6502 Collection After Assessment limits the IRS to 10 years to collect a tax debt. Ad Owe back tax 10K-200K.

Ad Do You ACTUALLY Qualify. After that the debt is wiped clean from its books and the IRS writes it off. As already hinted at the statute of limitations on IRS debt is 10 years.

The Internal Revenue Code tax laws allows the IRS to collect on a delinquent debt for ten years from the date a return is due or the date it is actually filed whichever is later. While most taxpayers receive a reprieve on. Start wNo Money Down 100 Back Guarantee.

This means the IRS should forgive tax debt after 10 years. This is called an offer in compromise or OIC. Ad Get easy-to-read rankings facts and breakdowns of Tax Relief companies.

Ad Honest Fast Help - A BBB Rated. Ad BBB Accredited A Rating. Under most circumstances it has 10 years from the assessment date to try to collect.

End Your IRS Tax Problems - Free Consult. If you have a tax debt with the IRS that is at least ten years old you might think that the agency doesnt have the ability to pursue you for collection. The statute of limitations that the IRS has to collect a tax debt is typically ten years.

Owe IRS 10K-110K Back Taxes Check Eligibility. This is called the 10 Year. The canceled debt isnt taxable however if the law specifically allows you to exclude it from gross income.

This means that the IRS can attempt to collect your unpaid taxes for up to ten years. Find out for Free. After that the debt is wiped clean from its books and the IRS writes it off.

This means that under normal circumstances the IRS can no longer pursue collections action against you if. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. The 10 years starts at the debt of assessment which is.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. The IRS generally has 10 years to collect on a tax debt before it expires. Ad Use our tax forgiveness calculator to estimate potential relief available.

The IRS does have the authority to write off all or some of your tax debt and settle with you for less than you owe. Ad 4 Simple Steps to Settle Your Debt. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

After a debt is canceled the creditor. End Your IRS Tax Problems - Free Consult. These specific exclusions will be discussed later.

The short answer to this question is yes the IRS tax debt does expire after 10 years. Talk to Trusted Tax Pro Now. How long can the IRS collect.

However there are a few things you should know about this expiration date. As a general rule of thumb the IRS has a ten-year statute of limitations on IRS collections. The day the tax debt expires is often referred to as the.

This means that under normal circumstances the IRS can no longer pursue collections action against you if. Ad BBB Accredited A Rating. Its not exactly forgiveness but similar.

Limitations can be suspended.

Common Irs Audit Triggers Bloomberg Tax

Can The Irs Take Or Hold My Refund Yes H R Block

How Long Can The Irs Try To Collect A Debt

What Happens To Federal Income Tax Debt If The Person Who Owes It Dies

How The Irs Determines The Statute Of Limitations On Collections

Does Irs Debt Show On Your Credit Report H R Block

Call The Irs First If You Owe And Can T Pay Your Tax Bill The Washington Post

Does The Irs Forgive Tax Debt After 10 Years

What Is Tax Debt Unpaid Back Taxes Can Cost You Debt Com

Irs To Individuals With Significant Tax Debts Act Now To Avoid Passport Revocations Diplopundit

Tax Debt Relief Irs Programs Signs Of A Scam

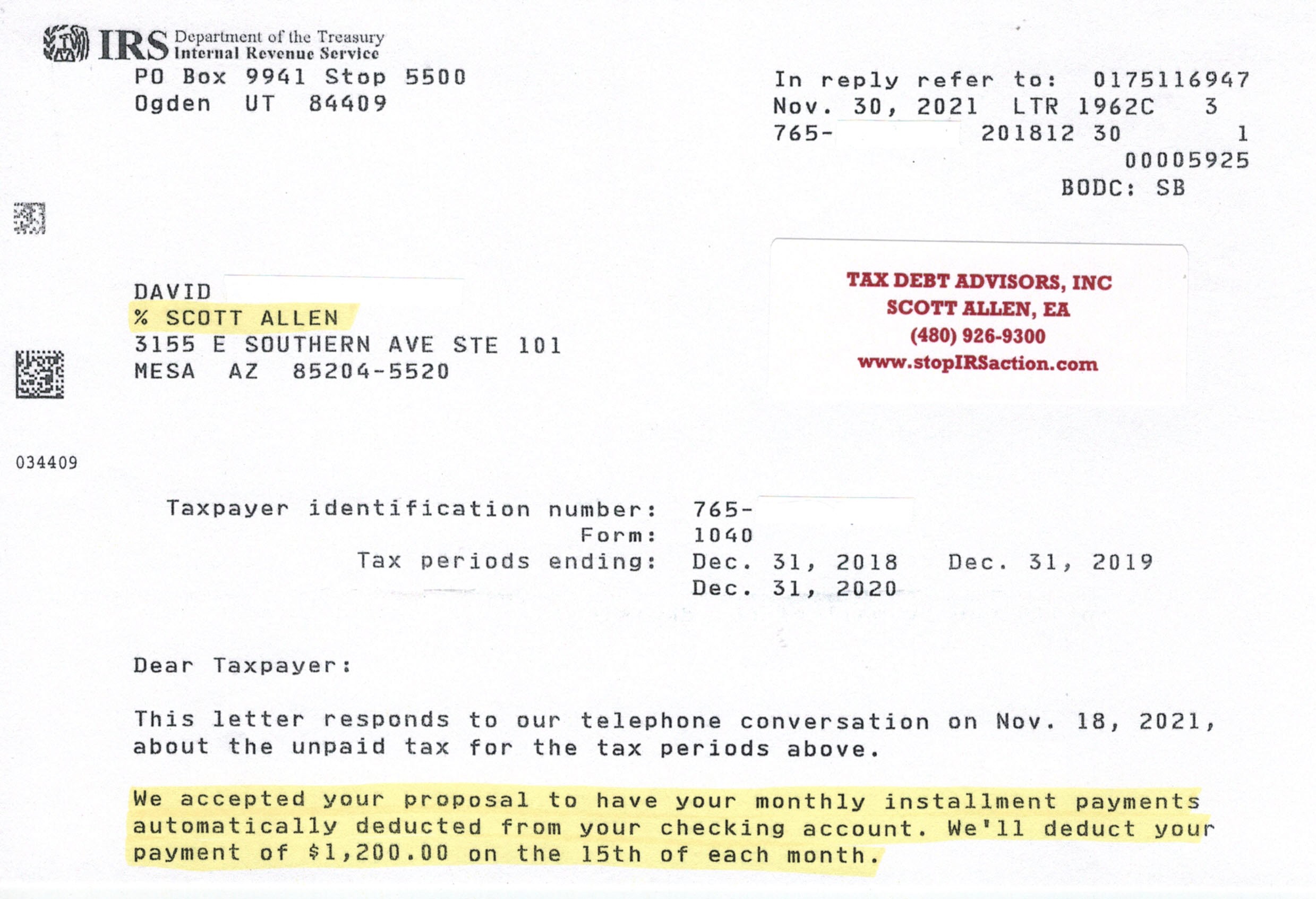

Does The Irs Offer One Time Forgiveness Tax Debt Advisors

/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

Tax Pros Horrified By Irs Decision To Destroy Data On 30 Million Filers

Tax Preparation Tax Debt Advisors

Does The Irs Forgive Tax Debt After 10 Years Heartland Tax Solutions

What To Do If You Owe The Irs And Can T Pay

Does The Irs Forgive Tax Debt After 10 Years

1 340 Irs Check Photos Free Royalty Free Stock Photos From Dreamstime